Operational Controls Service and App.

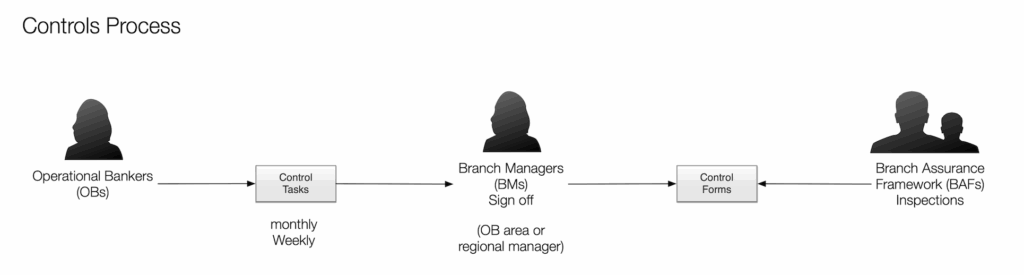

Banks have a complex and disparate set of daily, weekly and monthly operational tasks. So much so that Operational Banker is a role within them, which reports to the Branch Manager. The nature of this role and it’s tasks are so diverse, specific and unrelated that it is a difficult list of tasks for anyone unfamiliar with them. These include safety checks when opening the bank in the morning, checking till amounts, validating large cash payments and many more.

In many ways they are the junk drawer of critical tasks that are required to run a bank. The role of Operational Banker is like being a violin expert who has to learn a few chords perfectly on every other instrument with out needing to be able to play any of them fully.

These tasks run from the before the branch opens to after it closes, and they are critical logistical and regulatory requirements for all successful branches.

Challenge:

How do we turn multiple disparate Operational Banker tasks, that are currently done manually or entered via disparate software systems, into a single interface that lists, explains and prioritises operational tasks by their importance and due dates?

How do we recorded the outcomes for presentation and analysis at the various weekly, monthly and quarterly performance and risk meetings?

How do we still record, but escalate, issues that impact all branches, not just this one in order to make them visible to decision makers?

How do we make it easy for Operational Bankers to organise their work, see what they have done and what is left to do in the time remaining?

How do we give management visibility on the status of control checks?

How do we prioritise and automate triggering to carry out tasks at correct time in correct order – allowing for task dependencies?

New staff need to be able to just pick up and carry out the tasks – how can this be achieved?

Current tasks are paper based and this causes handling, storage and even hand writing legibility issues. There is also the issue of physical space on the form for some issues to be written.

Follow up tasks have to be remembered by the individual OB – there is no prompting system to ensure follow ups are carried out. How do we automate this?

There are numerous reference documents that need to be used to complete some controls – how can these be integrated into the process in a contextual and optimal way?

Mismatch between folder documents and actual process – how do we realign these in a compliant way?

Approach:

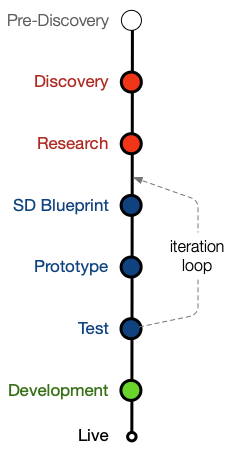

I carried out extensive end-to-end discovery and research on site at the branch, on the customers, employees, current reference architecture/technology solutions and service design process, accounting for regulations, bank branch operational procedures and security. Carried out OB interviews and multiple real-time daily observations of all OB tasks to establish a full picture of the process, steps, timelines and pain points.

I worked with the product owner and stakeholder to refine the Problem Statement to reflect the scope and needs of the business and the users/employees.

Explored the end-to-end service design across all of the tasks, systems, people and regulations. Mapped out their tasks, timings, journeys, manual vs software, delays, duplications, reporting, logging and times/costs.

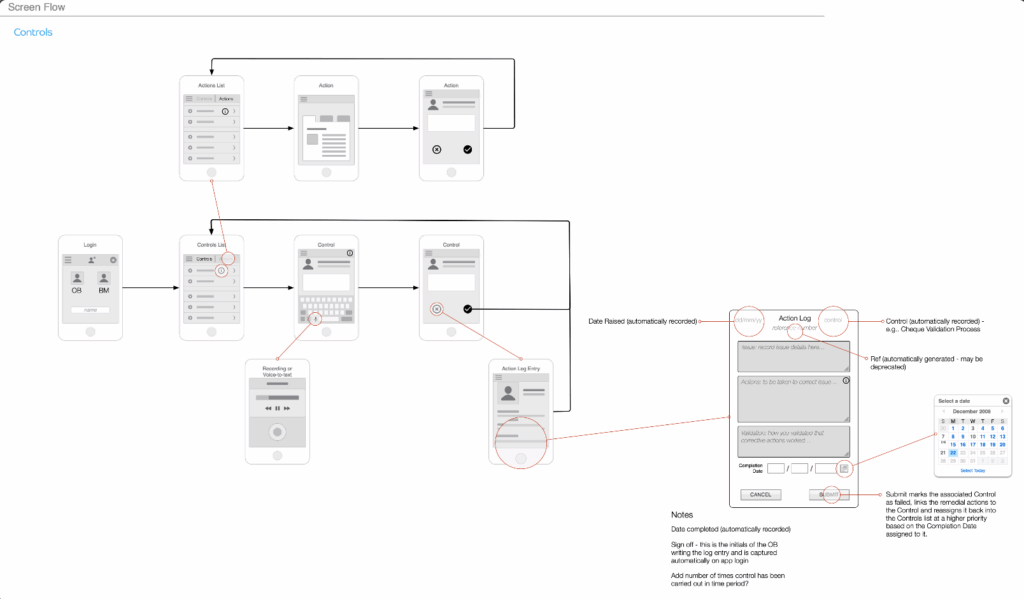

Created an optimised Service Design blueprint and worked with systems architects to introduce a solution that allowed the required back end services to be delivered, swapped out or upgraded seamlessly without affecting the new Operational Banker app.

UX Architected a new, responsive Barclays OB app functional prototype – primarily designed to work on a tablet, carried by the Operational Bankers.

Usability tested the prototype with OBs and made iterative changes according to user feedback. This was an app designed to fulfil a service design in action. Successfully tested and approved prototype was handed over to development for build.

Created multiple hand over documents and resources for the Development teams including a working functional prototype, all functional user stories and data location/journey.

Outcomes and Value:

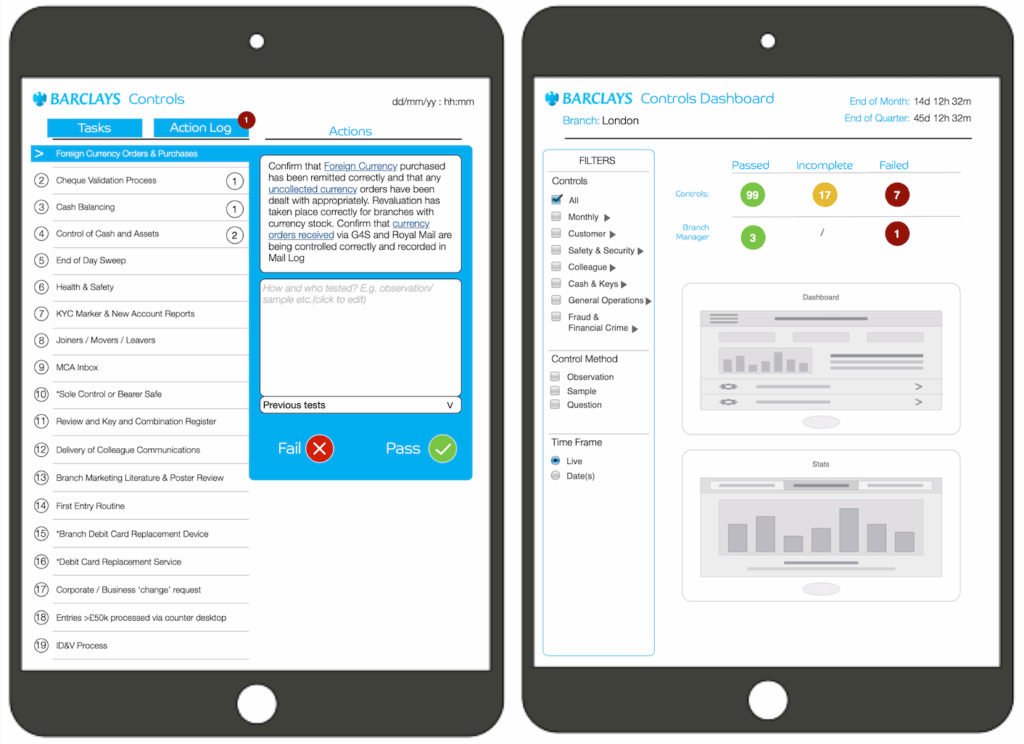

After research, service design, UX, functional prototyping and usability testing (and iteration) I arrived at a tablet based interface that allowed any Operational Banker to carry out all controls (bank generic or branch bespoke) via a single interface and record controls digitally and centrally. This provided data that could be fed to and analysed from Barclays reporting dashboards by auditors, branch managers and area managers – or wider.

I delivered on the goals of the project in full:

- Time taken to perform controls reduced by 30%

- Reduced reliance on paper documents and forms by 95% and removed their physical limitations by digitising data entry, whilst maintaining required compliances.

- Reduced need and cost for Auditors and Area Managers to visit branch by giving them centralised access online to control data for all branches

- Designed a solution that empowered the Operational Banker to carry out the whole control process from a single tablet interface.

- New staff could simply pick up the tablet and do the work, guided by the app at every step – no training required.

- Automated triggers ensured operational controls and follow-up actions were carried out at the right time, in the right order.

- Provided a guided operational controls task list, assigned to the user (new or existing) that guided them through all tasks

*customer supplied data

Testimonial

N/A

Product Owner –