Customer & Staff Credit Services Platform (CCI).

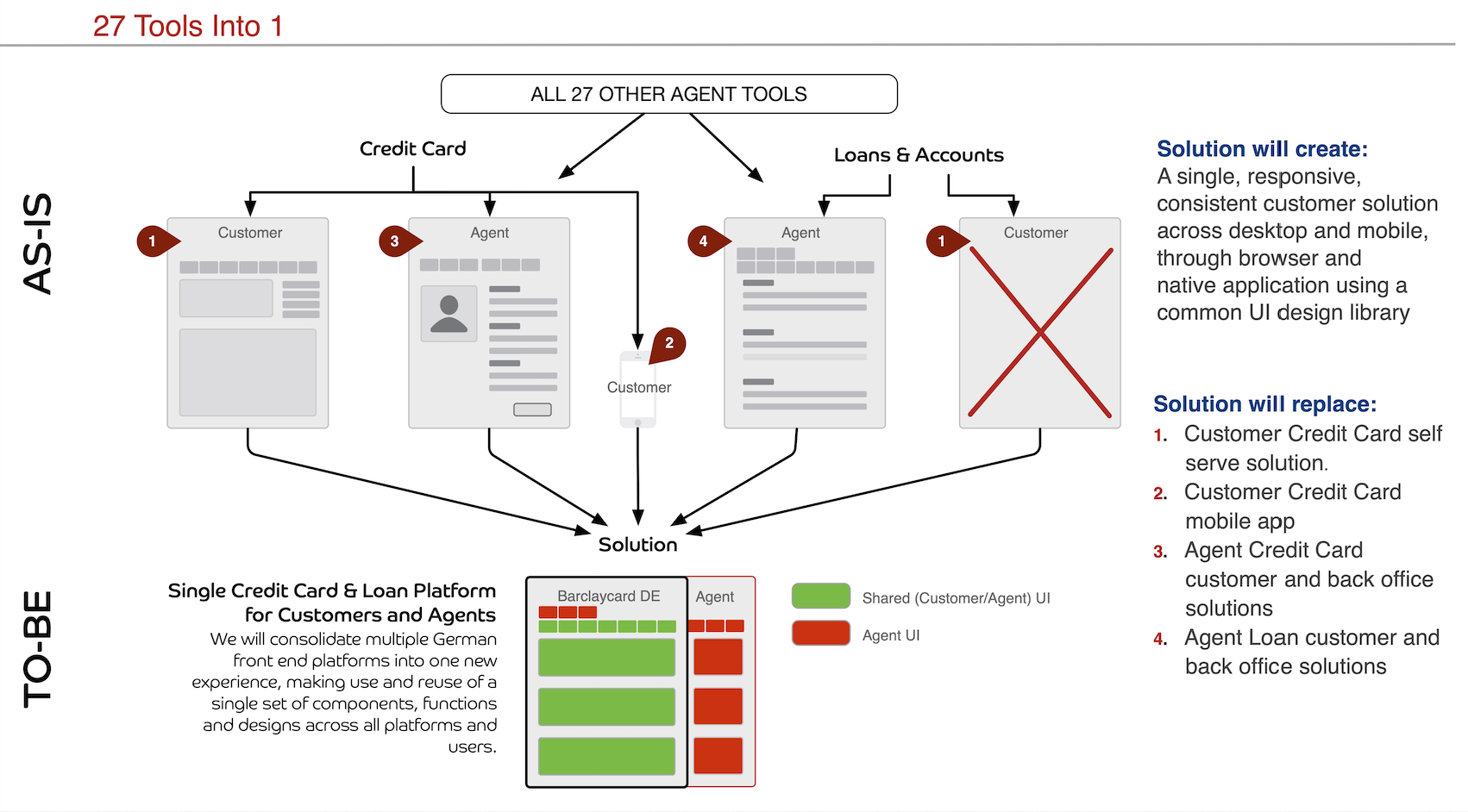

Barclaycard Germany had systems and solutions that provided the same customers with totally unconnected loans, credit card and account services, requiring three totally different sets of logins, personal details and accounts.

They wanted these totally reengineer into a single, cogent front and back end service and platform for desktop and mobile for their customers and their banking staff. They also wanted their business processes and team structures measurably Service Designed for maximum efficiency, reduced costs and optimal staffing.

Challenge:

Turn 27+ disparate banking, loan and credit card software related products, databases, services and solutions into one cogent application that serviced customers and staff alike, unify data, storage and secure access into a single secure source of truth. Solve the problem of training and scheduling staff to support customer’s needs in an efficient, predictable and manageable way. Improve reporting and monitoring, reduce the opportunities for fraud, standardise the banking experience to the highest standards, use the latest useful technologies and deliver services the user’s wanted, the way they wanted. Make a user experience that was intuitive, unified and comprehensive. Redesign the services so they were easy to sign up to, verify your identity and reduce the need for support at every step – reducing support costs.

Secondary goals, expected as a result of these changes and improvements: increase customer numbers, loan applications/approvals/uptake, credit card applications/average monthly spend, deposit amounts. Reduce defaults.

Approach:

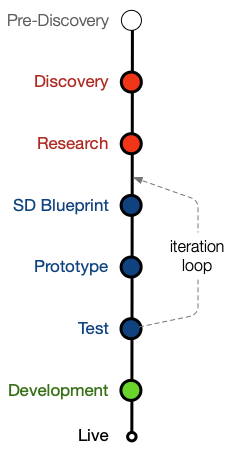

This was a Service Design and UX project. I carried out extensive discovery and research on the users, employees, current reference architecture/technology, current solutions and German banking/credit process, regulations and culture.

I worked with the product owner and stakeholders to refine the Problem Statement to reflect the scope and needs of the business and the users.

Explored the end-to-end service design across all products and services. Mapped out their journeys, air gaps, delays, duplications, manual interventions and times/costs. Created an optimised Service Design blueprint and worked with systems architects to introduce an abstraction/orchestration layer solution that allowed the required back end services to be delivered and upgraded seamlessly to the user/customer.

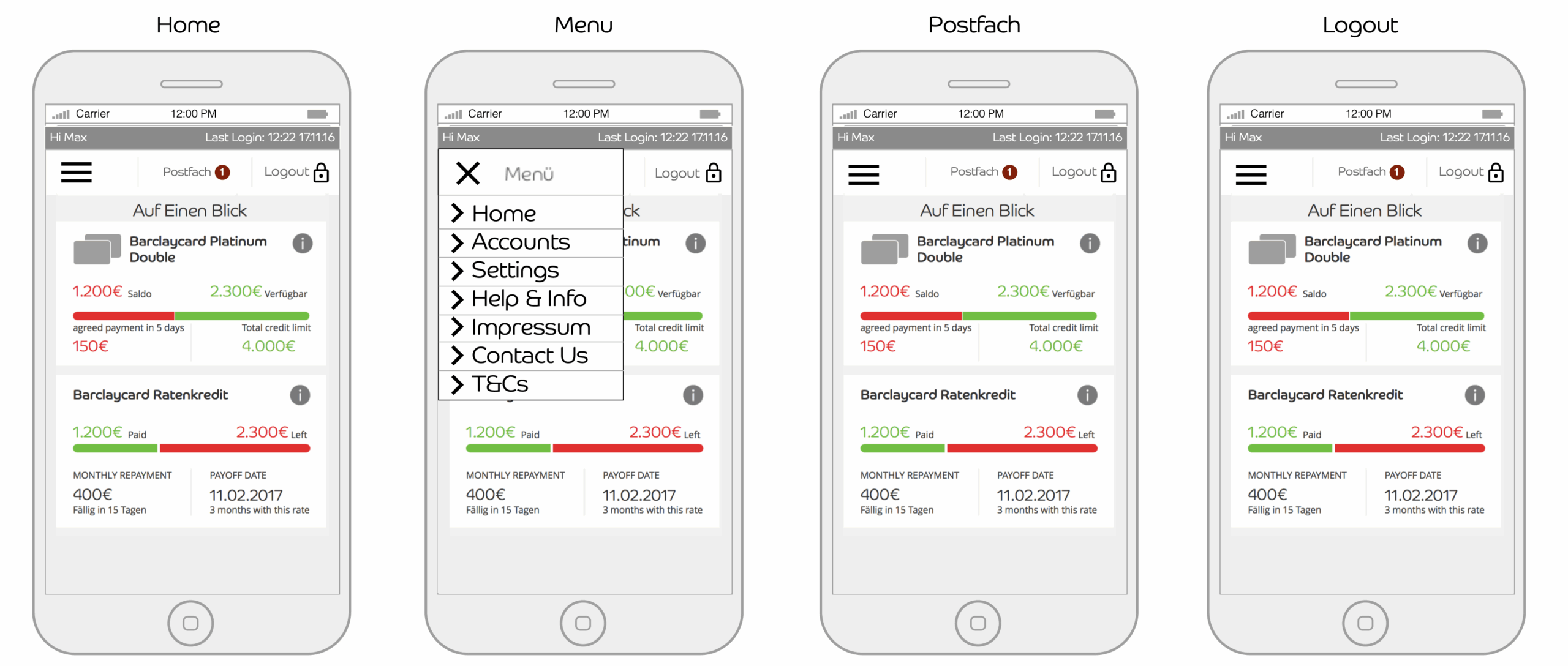

UX Architected responsive new Barclaycard interfaces, linked to back end services and rules, respecting ethnographical preferences, regulatory rules and technical limits/opportunities. These were hypothesised using user research data and by collaborating with the development, systems and stakeholder teams to ensure feasibility and optimisation.

Full optimisation and proof of acceptance was achieved by creating a fully functioning Axure prototype of all use cases, usability testing it with users, user lab studies and iterating prototype and service design from the results.

Created multiple hand over documents and resources for the Development teams including a working functional prototype, all functional user stories, data location/journey and responsive layout guides and development phase handover and involvement at a consultancy level.

Outcomes and Value:

A two phase approach initially introduced an orchestration layer to allow the new single, all in one interface to deliver 90% of the load, credit card and account services to the customers and employees, via a single interface, with additional employee functions and services, increasing efficiency and reducing development/maintenance costs.

Phase two was to replace old, not fit-for-purpose software and centralise databases and security protocols on the backend. The orchestration layer made this invisible to the users, increased the efficiency and utility of the current services and added the remaining 10% or services, all without having to make changes to the front ends (only adding a few additional functions). The service remained intuitive, as tested, and simply offered more utility, automation and/or speed.

- Clients were able to apply for and manage all their credit card, loan and account services from a single unified interface.

- Customer support requirements dropped by 40%*

- Credit Card application completions increased by 15% *

- Support team performance increased, and support cost and size were reduced by 35%*

- Loan applications increased by over 12%, lifting approvals, uptake and average monthly loan amounts*

*customer supplied data

Testimonial

Sean redesigned the entire customer and worker end to end UX and service blueprint that missed no user or worker need – even the exceptions were all considered and handled elegantly. The solution incorporated a clear and thorough understanding of the users, the business, the employees, the German culture and the technology, empowering everyone to do their job better and delivering a single platform that allowed Loans, credit cards and personal accounts to operate in an integrated, unduplicated environment. I can’t think of a more skilled person to design an organisation’s solutions and bring the delivery teams together under one single clear vision and the correct solution.

Product Owner – John Hottendorf